For individuals who rely on health savings accounts and high-deductible health plans, there is some good news on the horizon. Each year, the IRS announces inflation-adjusted limits for these plans, helping individuals save money on healthcare costs.

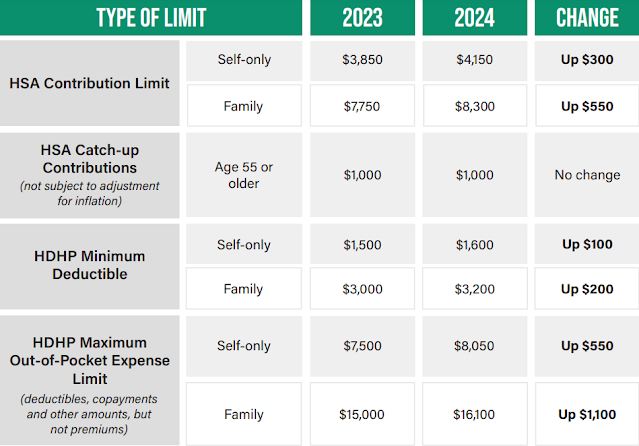

Looking ahead to 2024, the new limits bring some key changes over the previous year. Our free downloadable chart below shows how much individuals can save in their HSA accounts and what the minimum deductibles and out-of-pocket expenses will be. Read more about how HSA and HDHP limits will increase for 2024.

Of course, it's important to note that these limits don't apply to everyone, as they're only for those eligible for HSA-qualified HDHPs. But for those who can take advantage, the new limits offer a welcome opportunity to build up funds while taking control of their healthcare expenses.

If you have questions or need help determining your coverage, HANYS Benefits Services can help review your plans to see how the changes will affect you. For more information, contact us or call 800.388.1963 to speak with HANYS Benefit Services’ trusted experts about how you can prepare.

.jpg)